-

Have you considered investing in Real Estate to fund your child's college education? Great news... we have! And here are some ideas to consider. Investing in real estate has long been considered a stable and profitable venture. With rising education costs, many parents are exploring innovative ways

Read More

Categories

- All Blogs 31

- 2022 1

- 2024 9

- 2025 13

- Alabaster, Alabama 2

- Birmingham AL happenings in Jan 2022 1

- Birmingham-Hoover Metro 1

- Birmingham, Alabama 3

- Buy Real Estate 7

- Calera, Alabama 1

- Christmas 1

- CMA 1

- Community 7

- Deb Long 5

- Fair Housing 1

- Faith-based 3

- Fall 4

- Family 1

- February Events 1

- Find Your Home Value 1

- FREE Lunch with Deb 1

- home buyers 7

- Home Inprovement 1

- Home Maintenance 1

- home pricing 1

- Home sellers 6

- Hoover, Alabama 3

- housing trends 1

- innovation 1

- Investment Strategies 1

- Life Lessons 2

- Lifestyle 3

- Making the Selling & Moving Process Easier 1

- Memorial Day 2

- Memories 2

- MLS 1

- Mortgage Calculator 1

- Moving 2

- Newsletter 1

- Real Estate 4

- real estate tips 2

- Remember 1

- Sell Real Estate 5

- Selling Strategies 1

- Shelby County 2

- Spring Selling Season 1

- The Inside Scoop 2

- The Power of 1 1

- Today's Home Real Estate 3

Recent Posts

Preparing Your Home for the Cooler Months in Shelby County Alabama

The Story Behind the Signs

Relational Connectedness

The Break Buyers Have Been Waiting For

Proud to be an American

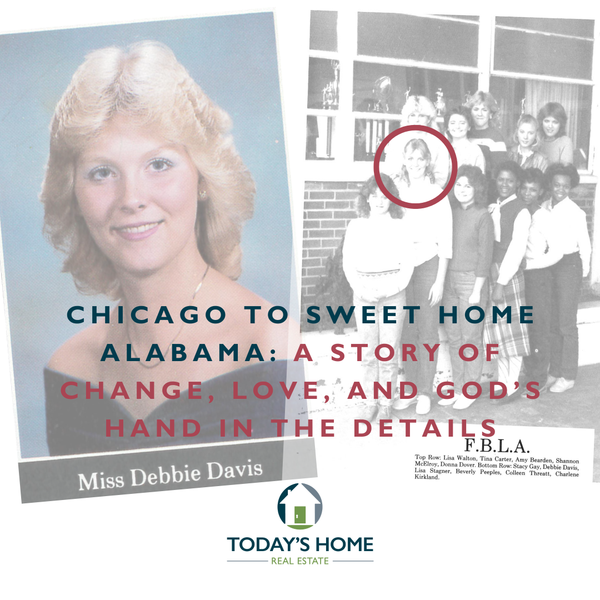

Chicago to Sweet Home Alabama

Honoring the Cost of Freedom: A Memorial Day Reflection

Tips for Buyers and Sellers in 2025

Understanding CMA: A Key Tool for Sellers and Buyers

The Role of a Real Estate Agent